The portfolio invests exclusively in the S&P 500 and Nasdaq 100 indexes. Using broad index ETFs reduces the risks associated with individual stocks through diversification and makes tracking performance easier.

The portfolio is divided into two buckets with the following allocations:

- Growth: 40%

- Income: 60%

Growth Bucket (40%)

- QQQ: 50%

- SPY: 50%

This bucket is designed to capture market upside and offers the flexibility to generate options income in the future. I specifically chose QQQ and SPY for their liquidity and suitability for options strategies.

Income Bucket (60%)

- GPIX: 25%

- GPIQ: 25%

- SPYI: 25%

- QQQI: 25%

I chose a diversified mix of covered call ETFs for the income bucket. At minimum, this income bucket should have a blended yield greater than 10%. These ETFs employ different strategies—some sell at-the-money calls, others out-of-the-money—and vary in how much of the underlying portfolio is used to generate options income.

Another key factor is tax efficiency. The income from these ETFs is primarily classified as Return of Capital, making it tax-deferred, which is ideal while I’m still earning a salary.

Platform of Choice

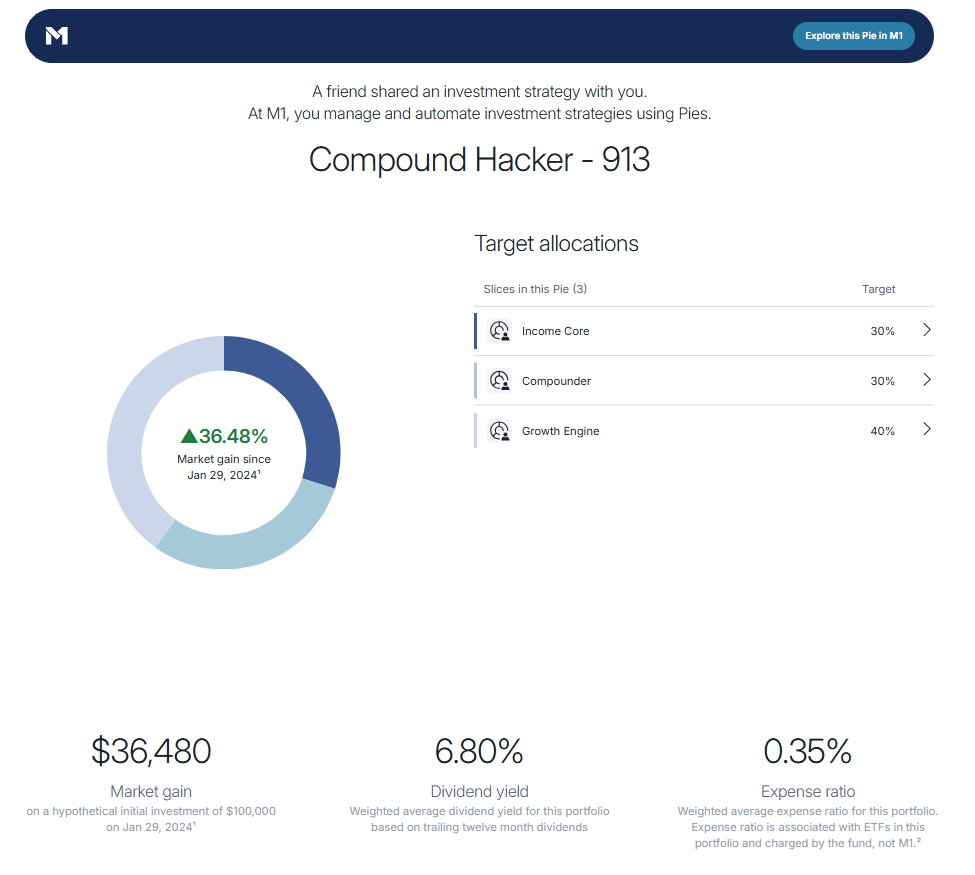

I use M1 Finance to manage this portfolio because of its automation and smart allocation features. It’s ideal for a set-it-and-forget-it approach while allowing flexibility for rebalancing as needed.